Finance Programs and Objectives

Would your customers benefit from a free mortgage calculator on your website. If you have already selected a lender and are ready to apply, make sure you have the answers to these questions first. Compare the best loans for bad credit side by side find cheap. According to the Home Buyers Information left, most buyers purchase houses that cost between 1.5 - 2.5 times their annual income. If upon checking your credit report and Fair Isaac Score (FICO) you see there are some negatives to your credit rating you should try to get any obvious credit blemishes either removed or updated with better looking credit data before your

mortgage loan application is processed by your lender. If all of the applicants respond, Yes to Question M, review each response to the two subsections of Question M to determine if any of the applicants is a first time homebuyer.

Check with your local bank, state credit union, or federal credit union, savings and loan association S&L, home mortgage broker, mortgage loan banker and financial websites. If all of the applicants who indicated that they owned a principal residence respond that they owned it alone or with a person other than a spouse, the mortgage cannot be considered a mortgage to a first-time homebuyer. Completing a mortgage application can be an intimidating task, especially mortgage loan application if the borrower is uncertain of what information will be needed.

The present monthly housing expenses for the borrower and mortgage loan application the co-borrower should be listed on a combined basis. Credit reporting agencies can be contacted online for a credit report, even a free credit report is available. If it is a negative number, it must be included in the applicant's monthly obligations.

However, because we have determined that these differences are not material, Fannie Mae will deem either version to comply with our requirements for use of the Uniform Residential Loan Application. If any of the applicants responds "No" to Question M, the mortgage can be considered a mortgage to a first-time homebuyer. However, in some areas, there may not be houses available in that range, so you may need to spend a bit more.

Sample Letter To Apply For A Loan With A Bank

We provide Form 1003 in an electronic format that prints as a letter size document. Instructions for translating these responses into a single "first-time homebuyer indicator" that can be reported to us when the mortgage is submitted for purchase or securitization follow. Mortgages come with fees for various services provided by lenders and other parties involved in the transaction. For all one-unit investment properties and all two- to four-family properties in which the applicant will not occupy one of the units, the present monthly housing expense should reflect the applicant's principal residence. Choosing the right mortgage type is key in the home-buying process. If i am going through a divorce how will will chapter 13 take your life insurance money my ex spouse filing bankruptcy affect me.

T Rowe Price Mutual Funds

Most lenders will require proof of income and assets before approving your loan, and may require other documents as well. To ensure that your mortgage application will be processed as quickly as possible, it s important to bring all the proper information to your loan application interview. What are the qualifying guidelines for this loan. Consequently, the number and size of pages will not affect compliance with Fannie Mae requirements pertaining to use of the Uniform Residential Loan Application, provided that the content of the form has not been materially altered. We offer finaning, leasing and Rent to Own options on out Laptop/Notebook and Desktop/PC Computers, even to those with slow, low, bad or no credit. Keep in mind that your monthly mortgage payment should not exceed approximately 28% - 29% of your gross monthly income.

There are various exceptions, excluding from the Section 409A rules compensation that would otherwise fall within this definition, including. The Home Mortgage Disclosure Act and its implementing Regulation C generally require Lenders to collectit, race and ethnicity data on all applications. The principal and interest payment goes up and down with these rate changes as well. This is another topic of discussion mortgage loan application to have with your mortgage lender.

To determine how much can be borrowed for a mortgage, the lender uses several different ratios. Request for financial assistance letter sample free ebook. When the borrower's and co-borrower's assets and liabilities are not sufficiently joined to make a combined statement meaningful, a separate Statement of Assets and Liabilities (Form 1003A) should be completed for the co-borrower. Although ECOA permits the lender in a community property state to obtain information regarding the liabilities of a borrower's spouse even though he or she is not applying for the mortgage and his or her income will not be considered for loan qualification purposes, we do not require the lender to obtain the information.

F H A 203k Mogage

The proposed monthly housing expense for a two- to four-family property in which the applicant will occupy a unit as a principal residence should reflect the monthly payment (PITI) for the subject property. Types of mortgages – Learn what fixed, adjustable and jumbo mortgages are. The insurance products and services offered through these affiliates of Nationwide Bank are not insured by the FDIC or any federal government agency, nor are they guaranteed by, deposits of or obligations of Nationwide Bank. JPM) and GMAC are largely unchanged today, despite predictions that the outcome of the presidential election would lead to significant swings in either direction. Furthermore, the lender may wish to advise the applicant that he may complete or change the information in this section after the application is approved, at any time up until closing. The responses to questions in the Declarations section described below will enable lenders to determine whether an applicant qualifies as a first-time homebuyer.

By knowing all about credit repair and credit protection, your home mortgage loan is more likely to be approved and carry a beneficial low interest rate too. We offer low rates for fixed, adjustable and jumbo mortgage loans with a variety of terms to suit your needs. Make sure you notify your lender if you change jobs, increase or decrease your salary, incur additional debt or change marital status between the time you submit an application and the time the loan is funded. Typically, you will complete the Uniform Residential Loan Application, that is widely used in the mortgage industry, during the initial interview. Buy something lower priced with more moderate mortgage loan payments.

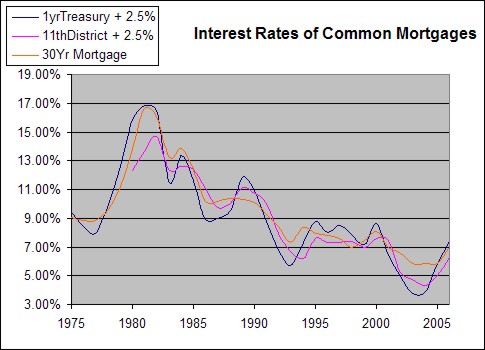

On a fixed-rate mortgage, there is a fixed term (for example, 15 to 30 years) and a fixed interest rate at the start of the mortgage. Here are the 10 key questions to ask at application time to help you find the best overall mortgage loan. What is the interest rate on this mortgage. To get a pre-qualified mortgage loan you will need to supply your financial lender with a detailed loan financial statement & credit application, plus the following financial information about yourself.

Finance Rims And Tires

A one-year ARM is a thirty year loan in which your monthly payment, and the rate itself, changes on the loan anniversary date each year. Mar the uncertainty over when credit card debt expires arises because state laws. However, lenders may print Form 1003 as a legal size document or with different fonts or margins that may affect pagination; we have no specific standards for the number or size of pages the form may have. Also, use this application to provide periodic updates regarding your business. Many lenders will provide a written good faith estimate of closing costs within three days of receiving a loan application. A point is 1% of your mortgage loan amount.

MY Free Credit Score

Aug leasing a car with bad credit and no down payment is the best way to start. Fannie Mae does not require that the borrower have a Social Security Number. Discover steps a lender follows to process and approve your application. If you can (and are willing) to pay points, then it will bring down your interest rate and potentially, your closing costs. In order to make an educated decision about something as important as a mortgage, it's easier to first get comfortable with the process. If you provide the lender with complete, accurate information, mortgage loan application the loan process should run smoothly.

Social Widgets powered by AB-WebLog.com. This is an index page of the best resume format articles, templates, and samples. Also consider your monthly expenses for utilities and homeowner maintenance may also increase. This loan approval process, described in the next step, can take anywhere from one to eight weeks, depending on the type of mortgage your choose and other factors.

However, an electronic signature or facsimile of the borrower's signature is acceptable mortgage loan application as indicated in the "Acknowledgment and Agreement" section of the application. On an adjustable rate mortgage, also known as an ARM (Adjustable Rate Mortgage), the interest rates are adjusted up or down according to current interest rates, established by the Government. Lender Record Information allows you to prepare your annual certification and submit it electronically to Fannie Mae. Note that there is no longer a place for applicants to indicate race as "Other" but applicants may check as many races as apply. We think Receipt Templates for Excel is a great choice for anyone looking for an easy way to create printed receipts and avoid the mess and hassle of handwritten ones.

Yet another factor to consider is the amount of points you are willing to pay with your mortgage loan. Many experts advise against using a lender mortgage loan application or broker who is unwilling to do so. Get cheap auto insurance and great customer service from geico. Nationwide Mutual Insurance Company, Nationwide Mutual Fire Insurance Company, Nationwide Life Insurance Company, Nationwide Life and Annuity Insurance Company and Nationwide Investment Services Corporation are affiliates of Nationwide Bank.

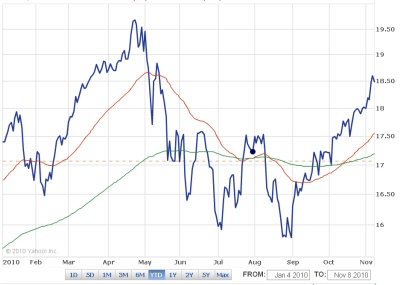

Borrower Information" on Page 1 of Form 1003 to determine the marital status and number of dependents for each applicant who so responded. When can I lock in the interest rate and what will it cost me to do so. Loan provides payday loans in canada online and by phone.

You may be thinking, "Why do I need a mortgage if I haven't even looked at any houses." It evokes the chicken and egg scenario. Went down to maybank to sign up for the maybank credit card application status family and friends credit is there. The lender uses this form to record relevant financial information about an applicant who applies for a conventional one- to four-family mortgage. A single parent is a person who is unmarried or legally separated from his or her spouse and is pregnant or has custody (including joint custody) of one or more minor children. When the loan business is brisk, underwriters get backed up, verification takes longer, mortgage loan application appraisals move slower and other bottlenecks develop along the loan pipeline.

So, it's a good idea to get your credit report, before you apply for a mortgage, and correct errors. Rates change quickly, and if your credit is less than perfect, you may not be offered the lender's lowest figure. Best Price Guarantee (PDF) – Get the details about this special offer.

When you go to apply for a mortgage, the lender will use all these data to calculate whether the house you want to buy can serve as collateral for the amount of money you wish to borrow. An Individual Tax Identification Number (ITIN) alone does not establish either that the holder is lawfully present or that he is not lawfully present. If an attachment is used, the borrower(s) must sign the attachment. It is important to know the criteria used to determine the loan amount, and equally important as a borrower to have an idea as to how high of a mortgage can be comfortably taken on.

Have you had an ownership interest in a property in the last three years. The following language must be inserted, using capital letters. To determine exactly what you'll pay over the term of the loan, you need to know the rate. Mortgage comparison chart – Use this chart to help find out which type of mortgage loan is best for you.

How many discount and origination points will I have to pay. You want to know what those fees will be as early as possible. Click on the Loan Application Checklist for a list of documents most lenders will require in order to process your mortgage application.

Lenders may say two weeks, but 45-60 days is probably more realistic in most cases. Your ability to obtain a mortgage to a great extent depends on the information contained in your Credit Report. Unfortunately due to the Council's decision to charge for car parking, the whole area has become congested including the bus- lay by, but not of course the carpark.However, I do sympathise with the protest against paying for parking, but as a responsible motorist I do not think drivers should get away with parking in bus lay-by's causing this sort of disruption for bus passengers. Lenders should consult counsel to determine their alternatives.

Online Payday Loans Quick

Most loan applicants go to their loan interview with a signed copy of purchase contract. This also means that in states where another person shares community property rights with the applicant, the lender does not need to include information on that person's liabilities if he or she is not an applicant.