Finance Programs and Objectives

If we can explain to the court why an expense is reasonable, there is a better chance it will be allowed. Often, the answer is yes because creditors usually elect not to go through the expense of challenging bounced checks in federal court. If you file for bankruptcy shortly after applying can i modify my loan if i do bankrupsy for a loan modification, there is a. If a debtor files bankruptcy without taking the course, the case will be automatically dismissed. You should consult your bankruptcy lawyer before

will chapter 13 take your life insurance money making any decisions regarding reaffirmation. The meeting of creditors is a scheduled meeting conducted by the Chapter 13 trustee where the debtor is examined under oath concerning his assets and debts.

The decision whether or not to reaffirm a debt is a serious one and needs to be discussed with your attorney so that all options are understood. Credit card fraud, embezzlement, larceny, defalcation, conversion, and certain IRS debt owed by non-filers can be discharged in Chapter 13 bankruptcy. These rules can be tricky, and Chapter 13 almost definitely cannot be done without the assistance of a bankruptcy speitt.

Chase mortgage refinance products understand refinance loan options your mortgage refinance loan. Under Chapter 13 bankruptcy, you must establish a Chapter 13 Plan to pay back all or part of you debt. Other differences may involve the length of time for the buy-back to be paid and how the buy-back amount is calculated.

The trustee can also ask for the case to be dismissed for a bad faith filing. The balance of the debt over the present market value of the property will be discharged. As a practical matter, creditors rarely attend the meeting of creditors.

Why Rushcard

Once your discharge is entered, if certain income and employment conditions are met, new automobile financing is immediately available at most car dealerships in Jacksonville. If you anticipate a death within this period, you should discuss the situation with your attorney. Banks normally do not make you close out your account will chapter 13 take your life insurance money unless you have a long history of NSF checks. Roadloans com is your option for bad credit car financing. However, if the debtor reaffirms the debt to the credit union, the credit union will not take such action. The trustee can also asked for the case to be dismissed for a “bad faith filing.” Moreover, federal law could be invoked to initiate criminal proceedings based on bankruptcy crimes.

Loan Companies That Doss Not Require 30 Days Of Active Checking Account

We help people struggling to pay their bills get a fresh financial start through bankruptcy. If the debtor stops paying on the asset after a Reaffirmation Agreement is signed, then the asset can be foreclosed or repossessed and a deficiency judgment obtained for the difference outside of the bankruptcy. Creditors who choose to attend the meeting either in person or through their attorney can ask questions concerning anything relevant to the case. The Chapter 13 trustee has the power to set these transfers aside. The Order of Discharge is normally entered about 110 days after the Chapter 7 case is filed. If you become eligible for discharge and have not completed the course and filed the certificate with the court, your case may be closed without a discharge being issued.

You must obtain permission from the Chapter 13 trustee or the court to incur new debt while you are in a Chapter 13 bankruptcy. An attorney will accompany you to the hearing. If it is not a consumer debt or if it is a consumer debt but will not be paid in full under the Chapter 13 plan, the creditor may proceed against the non-filer.

Factories That Make Roughcast Mobile Homes

A copy of the appraisal will be provided to the debtor and the debtor's counsel. It is difficult to get the trustee or the court to approve new credit until the plan is confirmed, which normally occurs two to three months after the case is filed. While the information presented is accurate as of the date of publication, it should not be cited or relied upon as legal authority. With customized loans, competitive rates apply for personal loans now and flexible terms, you can choose the. As we described in an earlier post, Chapter 13 involves paying your disposable income to creditors over a three or five-year period. Give us a call if you want to run a scenario by us.

Our firm offers a Life After Bankruptcy class to our clients free of charge. A debtor who has been found guilty of such transfers may lose his entire discharge and be subject to criminal prosecution. The inheritance is considered income and must be turned over to the Chapter 13 trustee to be distributed to the unsecured creditors up to the extent of the allowed unsecured claims. The court will determine whether or not to extend the automatic stay.

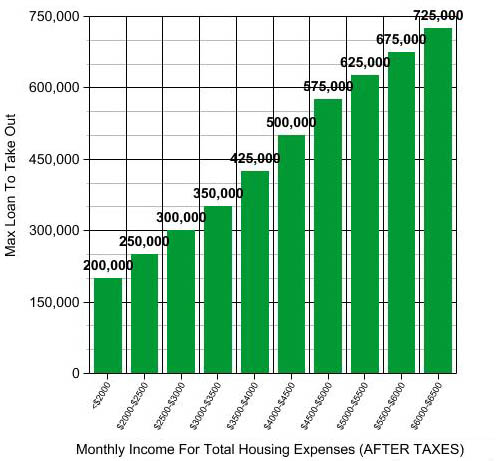

This seems exorbitant, until we realized that the client drives a gas guzzler and lives 60 miles from where he works. Most objections are worked out or resolved prior to the confirmation hearing will chapter 13 take your life insurance money but occasionally the court has to take evidence and issue a ruling. In some cases the debtor must commit all of his net take-home pay to the plan for the life of the plan.

Signing this agreement removes the asset from the bankruptcy and the debtor agrees to continue to pay for the asset as if the bankruptcy had never been filed. This also assumes that a lender has been found who is willing will chapter 13 take your life insurance money to loan money to an individual in a Chapter 13 bankruptcy. Moreover, federal law could be invoked to initiate criminal proceedings based on bankruptcy crimes. If certain conditions are met, new mortgage financing may be available after discharge with a substantial down payment. Then we look at things you should be spending on, but haven’t because you’ve been in financial trouble.

If there’s something that’s not on our list of ordinary expenses, that doesn’t mean we can’t deduct it, as long as it’s reasonable and necessary. Additionally, the co-signor’s credit report will almost always show the joint debt was included in a bankruptcy. To get from just-plain-income to disposable income, we need to subtract your expenses.

Creditors have approximately 100 days after the filing of the Chapter 7 bankruptcy case to file a lawsuit asking that the debt be held non-dischargeable. Such advice may be obtained from a competent attorney, accountant, or financial adviser. Not having sufficient records to satisfactorily explain the debtor's financial position or change in position can also serve as a basis to object to discharge. Additionally, the co-signer's credit bureau report will almost always show the joint debt was included in bankruptcy.

It won't show in the public records section. The bankruptcy will not protect will chapter 13 take your life insurance money a non-filing co-signor. This means the debtor can protect them from the will chapter 13 take your life insurance money reach of creditors and the Chapter 7 trustee. Because most debt is discharged in a bankruptcy action, mortgage companies and car, furniture, and appliance financers typically want the debtor to sign a document known as a Reaffirmation Agreement.

VA and FHA financing becomes available two years after discharge. The trustee can also file a motion to dismiss the Chapter 13 case for a bad faith filing or for failure to make payments called for by the plan. Under the new Bankruptcy laws that went into effect in October 2005, if you have had a case pending within the 12 months of filing a new case, the automatic stay, which stops your creditors from taking actions to collect on your debts (i.e. It is mandatory for all debtors to attend the meeting of creditors. The first payment is due 30 days after the plan is filed.

Credit can be re-established and should be used discreetly and only as reasonably necessary. This analysis should be completed by your attorney. Bankruptcy Basics is not a substitute for the advice of competent legal counsel or a financial expert, nor is it a step-by-step guide for filing for bankruptcy.

The payment is made by cashiers check or money order payable to the Chapter 13 trustee. It provides basic information to debtors, creditors, court personnel, the media, and the general public on different aspects of federal bankruptcy laws. You ll want to know which top gas credit cards credit cards give you the. The plan must be in the “best interests” will chapter 13 take your life insurance money of your unsecured creditors.

Online Payday Loans Quick

Your attorney should discuss with you what debts cannot be discharged. The certificate must be filed with the bankruptcy court before your projected discharge date. Your attorney will explain your options. Credit card solicitations usually begin almost immediately after discharge. The meeting of creditors is a scheduled meeting conducted by the Chapter 7 trustee where the debtor is examined under oath concerning his assets and debts. Also, plan payment must cover any priority debt, such as some tax debt or government penalties within the plan period.

Objection to discharge is controlled by federal law. Certain assets owned by the debtor have what is known as an exempt status. In addition, certain debt created by fraud, embezzlement, or conversion can be found to be non-dischargeable. Depending on which trustee is assigned to your case, will chapter 13 take your life insurance money the approach on the buy-back may differ somewhat. Oct the best auv and suv in the philippineslooking suv for sale philippines for the best auv and suv.

The creditor may continue to try to collect against the co-signer. Our job is to protect the money that is necessary for you to take care of yourself and your family. For example, if you are trying to get current on a mortgage, your total will chapter 13 take your life insurance money plan payments must cover the amount of your mortgage arrears. Within 30 days you must attend a hearing in front of a bankruptcy judge to explain why your previous case was dismissed and why your new case will be successfully completed. If one or more of these tests are not satisfactory, it is the trustee's duty to object to confirmation. In other words, in Chapter 13 your unsecured creditors can’t receive any less in the plan than they would have received in Chapter 7 if your nonexempt property was liquidated.

However, bankruptcy does not prevent the creditor from trying to get the State Attorney’s Office to threaten prosecution to force resolution on NSF checks. A Chapter 7 bankruptcy can be kept in the public records section of your credit report for 10 years.