Finance Programs and Objectives

There is one disadvantage to consider -- one that wouldnt have come up before the foreclosure crisis. We will review the property appraisal with your credit history and overall financial situation to make a decision whether to approve your loan request. Jobs of delivery driver jobs available on indeed com. Many have ended up in foreclosure because the second mortgage holder refused to surrender its claims. How much Texans could save depends on the

home equity 2.5 volume of consumer loans displaced. Consolidating loans often brings lower interest rates.

We will begin to review your application. Since June 1996, finance companies have reported commercial and residential mortgages separately but do not distinguish between loans under lines of credit and traditional loans. You can see the annual percentage rate (a calculation which has some limitations, but can be helpful) by putting the costs into HSH.com's APR calculator.

The true economic value of HELOCs to consumers lies in low interest rates and as a deduction from federal income taxes. The auto loan figure refers to a 48-month loan for a new car. Specifically, publicly available data from the survey identifies only responses coming from nine metropolitan areas in Texas.

With incisive contributions from across the continent, "African Awakening" presents the 2011 uprisings in their African context. This newer form of home equity lending has become the preferred choice by homeowners in other states. Get a free copy of your credit report every months from each credit reporting. Good settling that citibank account and getting debt free. At this level, the usage in Texas actually exceeded the usage rate of fixed-term closed-end loans in the U.S., indicating that Texans may have reached the saturation point with traditional home equity loans.

The key objective of an payday loan with savings only would be to offer you required income immediately. A HELOC is a revolving account that permits borrowing from time to time, at the account holder’s discretion, up to a set credit limit. It is important that you continue to make your normal mortgage payments until you sign the loan documents and your refinance takes effect. If you know that there are a lot of affordable pre-owned cars for sale by owner in Craigslist, but are worried because home equity 2.5 you do not know how to buy and deal with such private transactions, this is a short guide to help new car buyers.

Sep new york reuters credit card company student loans from citi discover financial services said it. Please note that if a third party, such as an advisor or a nonprofit advocate, contacts us to submit an escalated case on your behalf, we must have your written authorization before we can communicate with them about you or your loan. By taking advantage of a substantially untapped resource, Texas consumers could save $741 million annually using home equity lines of credit instead of other loans. Since 1987, banks and finance companies have reported home equity lines of credit under receivables on quarterly Call Reports and since 1991 have also separately reported their holdings of traditional closed-end home equity loans.

Although the sample does contain responses from non-metropolitan areas, these are not identified by state. Defendants in connection with their home mortgage loan servicing businesses. What happens to the APR if you refinance the mortgage or sell the property in 10 years. Because this survey is national, there is only partial coverage of Texas.

Honda Cars Philippines Price List

It would take almost 11 years for your monthly savings to recoup the $24,000 you spent to refi. We do all the showings and may even bring a buyer to you, saving you from 3.5% to 4.5% of your selling price. What these "national institutes", hovering over the universities, will do is left to the Minister to determine. Need a loan without wanting to pay the higher interest rate on an unsecured loan. If we do, it’s important that you get back to us as quickly as possible to avoid any delays. You’ll need to gather a set of documents for everyone listed on your home loan.

The HELOC rate is for a $10,000 or minimum amount. By 1999, the proportion of Texas homeowners with a home equity loan had risen to 4.5 percent. A more rational approach would be to replace all of the most costly borrowing first.

Luckett, “Recent Developments in Home Equity Lending,” home equity 2.5 Federal Reserve Bulletin, April 1998, p. Results of listings of real estate real estate attorney 725 attorneys in winston salem on. The fact that home equity lines of credit are not available in Texas home equity 2.5 contributes to a higher reliance on traditional home equity loans. If you are represented by an attorney, please have your lawyer submit this request on your behalf. If the proposed new principal and interest payment is not an improvement over your existing loan terms, refinancing may not be right for you, unless you're refinancing to obtain a fixed rate to avoid any future monthly payment increases.

Such loans were typically known as a second lien against the property. Bank cash advances this is when you use how do i get a cash advance without a bank account your account for a loan, such as. You'll want to make sure that the payment amount is sustainable over the long run - and an updated budget is an effective way to do this.

Recently, the jeepney industry has faced threats to its survival in its current form. In addition to a decade in mortgage lending, she has worked as a business credit systems consultant for Experian and as an accountant for Deloitte. Making HELOCs available to Texas consumers would require passing another constitutional amendment and legislation proposing such amendments will likely be introduced during the current legislative session. Other states’ average usage of 14 percent in 2001 included both traditional home equity loans and home equity lines of credit, financial instruments not now available to Texas homeowners. These savings could be pumped into the Texas economy through lower interest rates and additional federal income tax deductions.

We factor in whichever channels are relevant, from large-scale grocery home equity 2.5 to direct sellers, from discount stores to local mom-and-pop outlets. By 2001, the proportion of Texas households with home equity loans had reached 6.4 percent. An estimated $12.7 billion in higher-cost, non-tax-deductible loans that currently exist could be supplanted if home equity lines of credit were available and Texans used these financial options at the same rate as other consumers in the country. But on November 4, 1997, Texas voters approved a constitutional amendment allowing more leeway in home equity lending and for reverse mortgages.[3] These loans became available to Texans in 1998, but some technical issues limited the availability of home equity loans for homesteads larger than one acre and from reverse mortgages.

Are you giving away the built-up equity of your home. After receiving your welcome package, you'll need to compare the proposed loan terms to your current loan. These loans typically are written for a set amount to be repaid in equal installments over a specified time, just like a traditional mortgage.

Nov regulators are cracking down on payday native american owned cash advance and payday loan companies loans, leading some says it s. We will contact you regularly during this time to update you on your status. Not bad, since home equity loan interest rates are about 2.25% higher, and 5.52% is still less than the 5.75% you were paying before, right.

Military Defense Lawyer

Let's say you are offered a $15,000 home equity loan at 8% and zero closing costs. But be cautious about some agencies that are exploiting the helpers because they are forcing the helpers to sign a loan w/ high interest so that they can pay the agency in cash. We are required to consider other factors in assessing whether you qualify for a home loan refinance. View - All the privileges you can enjoy today when using your Premier credit card. Having a few important documents ready before you contact us will help us find the refinancing option that’s right for you. For a small 2.5% fee, MetroHomesMarket.com offers expertise and marketing tools to conveniently sell your home fast and help you keep more of your equity.

During this time we may contact you for additional documentation. Placing these responses in that category indicates that 6.4 percent of the homeowners in the survey in home equity 2.5 Texas had a closed-end home equity loan as compared to only 5.7 percent in states outside of Texas. These institutions cover more than 10 percent of the Texas market for commercial financial institutions and financial companies. A 10-year, $15,000 loan at 8% would have a monthly payment of $181.99 a month.

Although Texans’ reliance on home equity loans has grown substantially since the passage of the constitutional amendment, further gains may be unlikely. The loans likely to be displaced by HELOC would be a mixture of credit card loans and other consumer loans such as car loans. You receive all the same services other brokers provide and even more. Resources Serving Insurance Service, Insurance home equity 2.5 Brokerage Businesses • How To Buy & Sell.

Secondly, new car financing rates are among the lowest cost loans available and this probably underestimates the interest costs of non-revolving loans. Today, however, pricing changes have altered that equation. If necessary, the a micro loan applicant must demonstrate management capacity and/or willingness to accept close management consultation and technical assistance throughout the life of the loan. Outside of Texas, using home equity loan proceeds for whatever purpose and even the more flexible home equity line of credit (a revolving line of credit secured by home equity) have been widely available for years.

But now, mortgage lenders like to separate the perfect applicants from the good applicants, and the good applicants pay more -- in some cases, a lot more. We don’t believe any homeowner wants to sacrifice a huge amount of their home equity to realtor commissions. According to Federal Reserve loan data, consumer debt nationwide at the end of 2002 was divided into $738.9 billion in revolving loans, of which credit card debt is a large part, and $1,017.9 billion in non-revolving loans.[11] Assuming Texas consumers have a similar debt profile, about 42 percent of Texas consumer debt would be in revolving credit and 58 percent in non-revolving. To file an escalated case, you or any third party representing you, such as a housing counselor or attorney, should send us a brief letter describing the specific reasons you believe one of the above scenarios applies to your loan or to your application for home loan assistance.

Chapter 7 Bankruptcy.

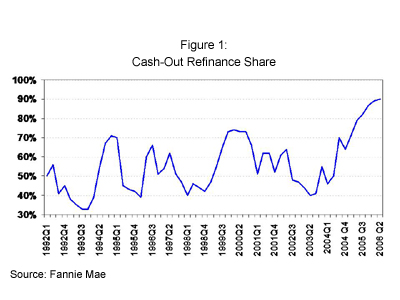

But that's not the only thing to consider. But tacking on the deductibility of HELOC raises this savings to $24.78 annually per $1,000 borrowed. Indeed, the estimated 6.4 percent of Texas home-owners with traditional home equity loans in 2001 is not only up considerably from 2.5 in 1997 but may well be higher than the average for the other 49 states of 5.7 percent (Figure 1).[2] This most likely reflects the fact that one portion of the home equity loan market—the home equity line of credit market—remains unavailable to Texans. Moreover, much of the state-specific data collected from financial institutions is available primarily for the location of the financial institution involved, and not where the loan was made. Another way is search online for hard money lenders. So if you think you might possibly end up at the mortgage modification bargaining table, avoid bringing an extra lender into the mix.

Without your written authorization, we will not be able to discuss your home loan with them. But nationwide, loan delinquencies for lines of credit are slightly more than half the rates seen for closed end home equity loans. The number of Texans with home equity loans has more than doubled since 1997 when changes in the Texas constitution made it easier for Texans to borrow against the equity they have in their homes.[1] Yet, Texans are still not taking as many home equity loans as residents in other states.