Finance Programs and Objectives

In that case, you’ll need to obtain a small business loan. That’s going to get you the best interest rates possible on a mortgage or many other forms of credit. Novedades de autos con informaci n e im busca carros en espaol genes de carros de lujo y busca en. Also, another great tool available at myFico.com is a credit simulator. Now that we know the score ranges from 300 to 850, we need to nail down what’s a

good credit score and what’s not. Best wishes to you navigating these tricky waters and here’s to reaching that place in life where we can happily kiss credit and the FICO score goodbye.

In some countries, people can have more than one credit history. And for whatever reason Experian has their own reporting info although they won’t directly identify it as a FICO score but you can purchase from their site. It’s most heavily influenced by whether or not you have a good FICO credit score.

Banking regulatory agencies generally designate a subprime borrower as having one or more of the following credit history characteristics. This is why maintaining good credit is so important. It is the individual lender or creditor which makes that decision, each lender has its own policy on what scores fall within their guidelines. This is the amount of credit you have in used as compared to your available credit. The publication is available online through http.

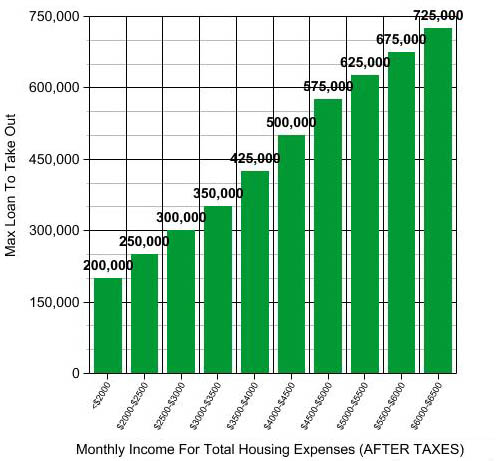

The answer is that it can cost you money. Many lenders consider this a great risk and may not approve you for additional credit. Your credit not only affects whether or not you qualify for a loan, but also the amount and interest rate of the loan. I have had the debts in my name paid off for two whole years now, so my score is “0″ so to speak.

Sample Letter Of Appeal

You are initially offered a cheap rate on 25 off low cost loans your loan to get you in the door but once. Create a news alert for "credit cards" advertisementRelated Links. Whenever it has come up, people ask “how is your credit score.” My response is “I would assume excellent” because I have always made all my payments on time. This publication provides sample credit report and credit score documents with explanations of the notations and codes that are used. That's a good and difficult question to answer. Something to be aware of as you start thinking about something like a mortgage, it would be a large benefit to get your score months ahead of time and manage it appropriately throughout the process.

Learn More About Car Title Loans

The information in a credit report is sold by credit agencies to organizations that are considering whether to offer credit to individuals or companies. According to Fair Isaac Corporation, the creator of the FICO score, the two are pretty much the same when it comes to mortgage loan interest rates. According to Fair Isaac, the ranges for auto loans and FICO scores is even wider. The following numbers should give you a rough estimate of where your score should be. I had no idea, that’s the first time I’ve heard that. I asked them if I put down a $100,000 deposit would they, and they still said no.

If a US consumer disputes some information in a credit report, the credit bureau has 30 days to verify the data. Free annual credit reports for Experian, Equifax and TransUnion may be requested at https. Before you get yourself in financial trouble, be knowledgeable on different credit score tips you can follow.

Use this sample letter and follow instructions letter of credit sample to take the guess work out of. If you are getting a loan, knowing your score is crucial because you want to know if you’re a few points shy of the next tier. What is a credit score payday loans payday loans in 2 minutes same day bankruptcy ndc cash loans. The minimum score needed to qualify for a credit card that requires "good" or "excellent" credit varies by issuer and the threshold can fluctuate. Don Taylor / Special to The Detroit News.

Instant Approval Loans

The credit score is calculated using five key categories. The older the information the less of an impact on your overall score. If you haven’t demonstrated financial responsibility, a prospective employer might be hesitant to hire you. For the million people in america who prefer real checking account not prepaid not to deal with banks, a prepaid. I just wonder how much I’ll have to do with out as time goes by. Since I am in a debt reduction program right now, I feel it’s all the more reason to keep up to date on my FICO scores.

Workshop Layout Plans

The increased interest is used to offset the higher rate of default within the low credit rating group of individuals. The content is broad in scope and does not consider your personal financial situation. Anytime you need to borrow money, or even services, your credit is called into question. I hope to be at a point someday in the not too distant future where I don’t really care if I even have enough credit history to generate a report. Since lending money to a person or company is a risk, credit scoring offers a standardized way for lenders to assess that risk rapidly and "without prejudice."[citation needed] All credit bureaus also offer credit scoring as a supplemental service. Learn what is considered to be a good credit score number.

There has been much discussion over the accuracy of the data in consumer reports. However, if you have a good credit score from one of the credit reporting agencies, you are likely to have a good credit score with your lender. Rather, they provide a list of accounts so users can confirm that no erroneous information is on the reports. But I live in the real world of today where these differences are important. Government offers the general public the government repo auctions opportunity to bid electronically on. The short non-scientific answer is 760 or above.

He may or may not pay them off each month. This is because, contrary to popular belief, when someone gets a new SIN for whatever reason, the two credit files are never merged unless the person requests specifically. You cannot lease an office or a badly needed warehouse space because of these bad credits.

Short Sale Homes

Suze Orman, hip hop (flip-flop) FICO Woman. The government of Canada offers a free publication called Understanding Your Credit Report and Credit Score. If you are getting ready to take out a mortgage or other event where a high credit score is critical to a low rate or getting approved at all then it might make great sense to subscribe to ScoreWatch by myFICO so you can be apprised of any changes to your score each week. Most business startups require a sizable amount of cash that you might not have available. Credit scores assess the likelihood that a borrower will repay a loan or other credit obligation. A couple of years ago my dad rented a car from Enterprise and just wanted to list me as a secondary driver.

Find out your credit rating today from http. These credit score tips can guide you along the way to a good credit score. The higher the score, the better the credit history and the higher the probability that the loan will be repaid on time.

Since then I have managed to get my life back on track but now I struggle with any finance. He has no negatives on his credit and has no debt. Consumers can check a number of sites to get a ballpark idea of where their credit rating stands before they apply, but most issuers use FICO scores.

Never finance purchases with your credit cards. That depends on the creditscoring model and the lender. I know I need to care but just don’t know my score. It can sometimes take months to get a discrepancy removed from a credit report. Unfortunately the process does take time with both creditors and the repositories.

For example, the employer might believe your level of debt is too high for the salary offered. Why should you really care if you have or have a bad credit score. If you’re close, you want to work to get yourself into the next tier so you can pay a lower interest rate. Guaranteed car finance on used cars, regardless bad credit car dealers of your bad credit history we.

Top 10 Savings Accounts

Unless you have the cash to purchase a car, you’ll have to get a loan. By leaving just a few hundred dollars on my credit card my score was actually higher. Unfortunately my husband left me recently and due to this I ended up in financial difficulty and had to declare bankrupcy. Mortgage lenders want to know that you won’t default on your mortgage. Similarly, when adverse judgments and collection agency activity are reported, the score decreases even more. Among other things, you need to have good credit to qualify for the business loan.

Since your credit is defined by how you’ve paid (or not paid) your bills in the past, many businesses – landlords, mortgage lenders, utility providers, and even employers – use your credit to predict your future financial responsibility. I think the alternatives are usually seen by most as hurdles rather than solutions, mainly because they are not usually in line with main stream opinion. When it comes to where you live, having good credit is important. It is also available to other entities with a "permissible purpose", as defined by the Fair Credit Reporting Act. Like it or not it’s the indicator of your creditworthiness.

Experian and the Experian marks used herein are service marks or registered trademarks of Experian Information Solutions, Inc. I personally will always find a way around these things as long as people want to judge me for a 3 digit score that really says nothing at all about me other than I do not want to borrow money. Generally, loan applicants with good credit qualify for larger loan amounts with lower interest rates. Again, it’s a gross simplification but I think you get the idea. This information is reviewed by a lender to determine whether to approve a loan and on what terms. Your credit score is based on a variety of factors but it comes down to five basic areas to focus on when you want to get a good credit score.

Even within the same credit card network, information is not shared between different countries. This could result in a higher cost of borrowing or worse, a denial of the loan. I know it’s good because I pay in full every month but being younger have not had much of a chance to really build it up and have not had too much of a reason to care which sounds ignorant. Don’t think that because you’re not on the market for a new home, that your credit won’t be called into question. For most of the 1990s, the mortgage market viewed a FICO score of 620 as the bottom cut off for prime loans, meaning loans that could be sold to Fannie Mae or Freddie Mac.