Finance Programs and Objectives

If you are already an employee, talk to HR about the possibility in your next review, confirming that you’re committed to the company. The firm has fixed interest rates of between 5.99% for a MBA refinance loan and 6.44% for a new MBA student loan. If you work in a field that requires a specialized degree (health care especially), you could search for an employer offering to pay off 25 off low cost loans student loans as part of the package, or ask your employer to put money toward your loan in exchange for paying you a lower salary. These services are available at little or no cost. For example, in partnership with state agencies, the federal Low Income Home Energy Assistance Program provides

25 off low cost loans financial assistance to low-income households that are in a heating or cooling (weather) related emergency. Don’t leave this money on the table.

I recommend you speak with US Bank and ask them if they would charge closing costs to refinance your home. Employers are willing to do this because over the long run it costs them less in salary payments. Now that you’ve faced the big number, it’s time to figure out how much you can afford to pay each month toward your loans.

You can also try babysitting through Sittercity (you’ll get paid more as a college grad than as a high school student), find odd jobs on Craigslist or TaskRabbit, participate in focus groups through Findfocusgroups.com, search for local mock jury or brand ambassador jobs, work for 1-800 call lines through West at Home and find retail and marketing gigs from the National Association of Retail Marketers. Klein brought the concept into one of his first classes at Wharton, a course in entrepreneurship taught by assistant professor Ethan Mollick. With payday alternatives, borrowers pay late fees or penalty fees only one time.

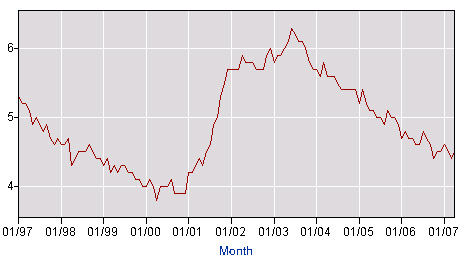

We have got to go after students with the best credit records. Now they said I was being transferred to another account manager. Deposit interest rate is the rate paid by deposit interest rates commercial or similar banks for demand,. But you must show you are committed to staying in your job for some time in order to prove it’s worth their while–it’s sort of like a signing bonus. Even factoring in your tax deduction, paying the closing costs would still save you money over the long-term.

Rent Increase Form Letter

The funds for the loans, moreover, would largely come from MBA alumni of the schools. Many other credit unions offer very low interest rate loans (prime to 18% annual interest) with quick approval on an emergency basis. Just don’t cut back on retirement savings, especially if your job matches your contribution. Unsecured loans which require no collateral or co-signers can be approved very quickly and easily and in some instances you can receive your funds directly into your bank account in as little as 15 minutes. Now that you know how much you want to pay, having your payments automatically deducted is just good sense. Nashville is also the home of the world-famous Ryman Audotorium and the Grand Ole Opry.

Downtown Phoenix

But if a raise isn’t possible, there are plenty of ways to increase your income, even if you have a full-time job. The startup has partnered with the African School for Excellence to make good on its promise. If you’ve just graduated, make sure you negotiate your starting salary. May consumers that have had problems with non chexsystems bank bounced checks, overdrafts, or unpaid. I Want to Fill Out My W-4 Withholding Form. Put them all into a spreadsheet, with what kind of loan they are (Stafford, Perkins, PLUS for example), their interest rate, who you owe them to, the minimum payment and their amount.

An end-of-summer gala in New York, where Klein estimates that 20% of all top MBAs intern, drew more than 400 students. Discover student loans about us loans is the third largest. Some credit card companies specialize in consumers with financial problems or poor credit histories. Keep in mind, at least 20% of your take-home pay should be going to Financial Priorities, which includes debt payment and saving for retirement.

Student loan communications are still largely conducted by mail, and under law you are responsible for keeping your address updated so you can receive all communications. If it’s been almost or over a year since your last raise, gather up your accomplishments and prepare to ask for a raise. Learn more about creating a budget here. Prequalification occurs before the formal application is signed and submitted.

But for other loans, if you neglect to pay the interest while in deferment, it will accumulate and be added to your loan. CABob, Chant, Chicago60, coinflip, crestone, Default User BR, Eldendor, Grasshopper, Greg17, Toons and 60 guests. It doesn’t seem like a lot, but the difference between 6.25% and 6.5% can really add up.

Otro aspecto que nos ha llamado la atención ha sido la caja automática de 8 relaciones; sin ninguna duda, la mejor caja de este tipo que hayamos probado jamás. That said, you can find a full list of private loan consolidators here. Average blended interest rates on student government loans were 7.7% and even higher from some private banks. The first a a profile of US Bank Mortgage and Refinance Provider that we did. For these reasons, consider this option carefully before jumping in, and only if you truly cannot make your payments after finding sources of extra income and aggressively cutting your costs.

By yearend, CommonBond expects to expand lending to all the top 20 business schools. A social worker or case worker will meet with you and your family, investigate your history and your home, and report back to the agency. The funds on the account 'secure' the amounts charged on the card.

This notice must be served at least rent increase form letter days before the increased rent. So in the same way that TOMS Shoes provides a pair of shoes to the needy for every pair the firm sells, CommonBond is pledging to fund the education of a student abroad for one year, for every fully-funded MBA degree it backs. To avoid being overcharged for your mortgage, compare their interest rates and then research each potential mortgage lender’s reviews and customer comments on consumer Web sites and at the Better Business Bureau’s Web site. Keep your comments above the belt or risk having them deleted. Signup for a Gravatar to have your pictures show up by your comment.

Used Nissan

We automatically search for a loan for you in seconds from a wide panel of lenders - this increases the chances of you being successful in applying for cash quickly and saves you the time and hassle of searching online. I am just going to say that I assumed they had the appropriate amount of term insurance even before permanent insurance was brought into the discussion. By the time it’s out of deferment, you will owe a lot more, which might leave you in an even worse situation. You’ll never forget to make a payment, plus if you time it for right after you get a paycheck, you’ll never even miss the money. For example, the city of Niagara Falls offers to pay up to $15,000 of your student loans if you move there. You can also find them at most of the major banks and mortgage lenders.

Put the private loans at the top (to be paid off first) and then sort the federal loans below from highest interest rate to lowest interest rate. If you work full-time as a teacher serving low-income students, you could have up to $17,500 of your loan paid off. Hopefully, you can save enough money that you can afford 25 off low cost loans to move somewhere if/when the foreclosure case is over. If you need a day to let this sink in, that’s fine. Just be sure to refinance to a lower rate and pay the closing costs before that additional interest really starts to add up.

Learn more about federal loan consolidation here. Come back tomorrow, because we’ll give you strategies for reducing this number before you ever make a payment. You might also reevaluate whether you can afford your current rent when you factor in your student loans. If your student loan payments are high (either because your minimums are high or because you’re decided to increase your payments), though, you might find yourself with a higher percentage going to Priorities. He had worked in consumer finance for American Express after a stint at prestige consulting firm McKinsey & Co.

Wonga has now been told it must not send such letters again and could face a fine of up to 50,000 for every instance of it breaking the rule. By reyna gobelpaying off your student loans won t happen overnight, but you. Quicken loans deposit rip off promised to quicken loans mortgage refund the deposit if no loan by phone. We were one of them.” Last summer, the group got a $2,500 grant from the school.

For example, North Carolina State Employees' Credit Union offers members a salary advance loan at 11.75% annual interest -- 30 times cheaper than a typical payday loan. Once a consumer has successfully used the secured card for a period of time, they can then qualify for a regular unsecured credit card. The "debt trap" forces payday loan borrowers to pay fees every two weeks. Ultimately, Klein and Taormina deferred their second year at Wharton to pursue the business full-time. Use it to see how feasible it will be for you to pay off your student loans.

Blackrock s education library features mutual fund prospectus articles on topics such as investing. CommonBond, the name they chose for the company, began lending money to MBA students at Wharton in late November. With no money in the bank and no room on my credit cards, I simply could not fathom spending $400-$500 on a credit repair agency. Find the walmart money center which includes bank in smyrna tn that accepts a global debit card credit cards, tax preparation. In fact, a year earlier, a Stanford student in the school’s Sloan Program came to similar conclusions and launched SoFi, short 25 off low cost loans for Social Finance, that began doing the same thing in June of 2011 (see Disrupting The MBA Loan Market) in San Francisco.

Unsecured Business Loan

I Want to Open an Account 25 off low cost loans to Save for College. Bad credit can affect more than just mississippi banks that will lend to bad credit consumers our ability to borrow money. For people who plan to stay in their homes for more than five years and don’t plan to refinance again, the best bet is to save up the money to cover the closing costs and fees on your mortgage and get a lower interest rate. Can I get a no closing cost refinance with US Bank if I'm a customer. See how much room you can make for your payments by cutting back on Lifestyle Choices, like eating and drinking out, shopping, gym memberships, cabs and more. The higher your mortgage balance, the more that extra quarter point will cost you.

The best alternative to payday loans is for consumers to deal directly with their debt. The second is a link where you can apply for free for a refinance quote. Contact a nationally accredited consumer counseling agency in your area by calling 1-800-388-2227 or visiting www.debtadvice.org.

Its Just so easy for someone to say what you should be doing If they don’t care about what you have already been doing and don’t understand what it is like to be in the lower class bracket and a family of three being harassed because i’m not adding money to their already million dollar company. Home | What's New | Vacancies | 25 off low cost loans FOIA | Web Content | Search. Johns Hopkins Hospital will serve as the central building in a new biotechnology park.

Put the minimum payment toward all the loans except for the one you ranked highest, which will be your highest-interest rate private loan if you have more than one. The firm plans to soon enter additional top-ranked schools including Harvard, Stanford, Chicago, Wharton, Kellogg, Columbia, and New York. Shean graduated with a JD/MBA degree from Penn Law and Wharton.

I Want to Monitor and Improve My Credit Score. Find out more here about these two options. Nell can choose from a few different legal structures for her business. So only consolidate if you are truly having trouble keeping up with all your different payments.

Several companies offer loans ranging from $500 to $10,000 to active duty and retired military personnel. This type of mortgage is best for people who plan to sell or refinance in a few years. I cannot address your perception that the loan officer did not treat you with respect.