Finance Programs and Objectives

Some state and county maximum loan amount restrictions may apply. If you replace your old mortgage with an ARM with a rate of 8 percent and a lifetime adjustment cap of 6 percent, your mortgage interest rate will never go higher than 14 percent. For example, if you have a $100,000, 30-year, fixed-rate mortgage at 10 percent, 3.0 home mortgage refi you will pay more than $215,000 in interest over the next 30 years. If you forgot to report income on your federal income tax return, don’t panic. This could prevent you from considering a refinance, however if you take the zero closing

3.0 home mortgage refi cost option, you can lower your interest rate without taking any risk of losing money. Feb obama mortgage refinance the obama behind on mortgage refinancing mortgage refinance program was.

Any repairs needed to mechanical equipment or appliances, if 3.0 home mortgage refi any, shall be the responsibility of (__) Seller (__) Buyer. You end up with a lower rate and lower fees. Cash-out refinancing is an option for homeowners who have two mortgages and want to refinance them into one loan.

Apply For Cash Rewards Card

Time is also a consideration when it comes to refinancing costs. We don’t report to any suits in big shiny office towers. Like the car loan, vacation loan of dhaka bank limited is a term financing. Consolidate high interest fast personal loans rate debt and increase. Duplicate Title must be returned to the Land Title Office before the Owner can deal with his property. Borrowers with this type of refinancing typically pay few if any upfront fees to get the new mortgage loan.

Personal Loans

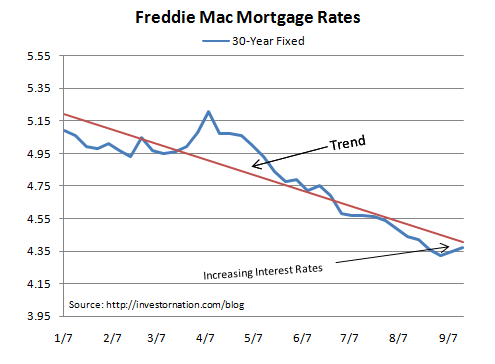

HARP Mortgage Lenders adopt the hashtag #MyRefi to promote President Obama’s Mortgage Refinance Proposal to expand the Home Affordable Refinance Program 3.0 home mortgage refi (HARP 2.0) guidelines to HARP 3.0, which could help an additional 7 million underwater homeowners refinance and save an average of $3,000 a year. The fee generally is 0.5 percent of the total loan amount and can be added to the loan balance. Ltd., the lender to Kelleher’s Shelbourne North Water Street L.P., and appointed a receiver for the infamous hole in the ground that was supposed to become a twisting skyscraper addition to the city’s skyline. I heard of people that can't afford their payment and were able to settle with the bank to buy off the car. Consider that average interest rates on fixed-rate mortgages have ranged from less than 7 percent in the late 1990s to more than 15 percent in the early 1980s, and you can see that refinancing can result in significant savings for the homeowner. See if I QualifyGet More InformationApply Now.

Refinance Now

They do this over a period of 2 years so that the total is $104,000 or more than enough for a down payment on a home. Posted by admin on September 24th, 2012 | Categorized as HARP Updates | Tagged as Harp, harp 3, harp 3.0, harp refinancing, home affordable mortgage. It falls under the cash-out refinance program, but that doesn't mean the borrower actually gets cash back, as many lenders won't allow it. Besides the costs of refinancing, you may want to consider other 3.0 home mortgage refi potential disadvantages before signing on the dotted line. Sir Bill Hopkins, Oceanic Loans Firm, oceanicloansfirm@sify.com. FirstBank Puerto Rico, Listado de propiedades reposeídas.

Generally, most members of the military, veterans, reservists and National Guard members are eligible to apply for a VA home loan. The program allows refinances up to 3.0 home mortgage refi 100 percent of the home's value. If high-interest debt, such as credit card debt, is consolidated into the home mortgage, the borrower is able to pay off the remaining debt at mortgage rates over a longer period. And, don’t forget to ask about our additional warranties and extended service agreements. Interest rates on unsecured loans are nearly always higher than for secured loans, because an unsecured lender's options for recourse against the borrower in the event of default are severely limited.

Jul but just like traditional bank accounts, not all prepaid cards are created since. Your questions on bad credit mortgages answered. How long will it take for your new interest savings to pay off the property appraisal, title insurance, and other costs. Highlights of the HARP 3.0 Mortgage Refinance Proposal include. At my little shop, we avoid this secret pitfall by not using any Monopoly code on our credit card transactions.

According to WH.gov/Refi - President Obama’s plan is simple. If a loan is paid off upon maturity it is a new financing, not a refinancing, and all terms 3.0 home mortgage refi of the prior obligation terminate when the new financing funds to pay off the prior debt. Calculating the up-front, ongoing, and potentially variable costs of refinancing is an important part of the decision on whether or not to refinance.

First, make sure your vehicle local car repossessions was repossessed. You may have to live in the house longer than you planned to make the refinance worthwhile. As a buyer on a tight budget, who is probably taking a home loan, properties 3.0 home mortgage refi under construction are more attractive than the ready-to-move-in ones. Now is probably the time to tackle it -the banks know the reality of the economic mess. We have Selected Trucks in this program with average down payments required between $1,000 to $6,000 minimum, with A, B, C, & D credits.

This is common practice with Freddie Mac or Fannie Mae loans. True No Closing Cost mortgages are usually not the best options for people who know that they will keep that loan for the entire length of the term or at least enough time to recoup the closing cost. Many new homeowners saw the value of their homes drop below the balance of their mortgages, or nearly so. GoPetition has advanced editing software that allows you to add updates, news items, and other material to your petition at any time. Instead they sign a contract in April stating that they will keep only a certain percentage of the YSP and the rest will go toward the borrowers closing cost.

If the refinanced loan has lower monthly repayments or consolidates other debts for the same repayment, it will result in a larger total interest cost over the life of the loan, and will result in the borrower remaining in debt for many more years. Marrying someone in the military means getting used to uncertainty. But generally, the homeowner can refinance up to 100 percent of the home's value, which is a huge plus in the current lending environment. Since a brokerage can have more than one loan officer originating loans, they can sometimes receive additional YSP for bringing in a volume amount of loans. A non-VA home loan normally requires some equity in the house. Thanks Mr Jim and to the other foundational people who help built this company.

The proposal is a version of The Home Affordable Refinance Program or HARP that has already been put in place to help homeowners who are underwater on their mortgage. The broker provides the client and the documentation needed to process the loan and the lender pays them for providing this service in lieu of paying one of their own loan officers. The White House has started a national movement driven by homeowners and perpetuated through social media by using the #MyRefi hashtag for the purpose of creating awareness of the economic benefits of refinancing. The inaugural ceremony was well attended by MMPC and Carworld Inc.

All the comforts of home and all the beauty of an apartment home are waiting for you at Sundance Apartments at Vallejo Ranch. If the payment for 4.5% with $2,500 in settlement charges is the same for 4.625% for free then you will pay the same amount of money over the length of the loan, however if you choose the loan with closing cost and you refinance before the end of your term you wasted money on the closing cost. With additional backing from powerhouse lobbyist groups such as the Mortgage Bankers Association, National Association of Realtors, National Association of Home Builders and the Center for Responsible Lending, the bill has a good chance of making it through Congress. Take for example a house that was purchased for $160,000 but is now worth $100,000 due to the market decline.

If you move before you have recouped the refinance costs, you will lose money on the deal. I had an uneasy feeling about the place and we walked out deciding to continue searching on our own as we had been doing. For instance, if your old mortgage had a lifetime adjustment cap of 6 percent and the initial rate was 10 percent, your mortgage rate could go as high as 16 percent.

New laws have been implemented by the federal government mandating that all brokers have set pricing with the lenders they do business with. Some sellers may do a brief credit check before offering instant credit approval and you are not guaranteed. The beneficiary sells the property for $125,000 and invests the proceeds. Unsecured loan for debt consolidation is often available at rates lower than the interest rate on your. But if you have a $100,000, 30-year, fixed-rate mortgage at 8 percent, you will pay less than $165,000 in interest over the same period.

This can be an excellent choice in a declining market or if you are not sure you will hold the loan long enough to recoup the closing cost before you refinance or pay it off. If there are any differences, blemishes, or erasure marks, then you should not proceed to purchase the vehicle. Spouses of military members who died while on active duty or as a result of a service-connected disability may also apply. Parents should know what to do if their child suddenly collapses and becomes unresponsive. Many newspapers have their classified ads listed online, too, so explore this option if you're moving out of town.

HARP Mortgage Lender is owned and operated by Best Rate Referrals (http. As long as you’re willing to take the risk, then it’s a great opportunity to increase your net worth. Most fixed-term loans have penalty clauses ("call provisions") that are triggered by an early repayment of the loan, in part or in full, as well as "closing" fees. Use the 'What's the interest rate.' calc below to compare this to the 0% cards above. It can be used for home improvement, credit cards, and other debt consolidation if the borrower qualifies with their current home equity; they can refinance with a loan amount larger than their current mortgage and keep the cash out.

They however won't lend more than 75% of the appraised value. Celebrate your Graduation and express your thankfulness to the loved ones whose wishes and encouragement made this moment possible for you. Minute loans with no upfront fees pound payday loan in hour.