Finance Programs and Objectives

The cash advance outstanding balance will be the previous statement balance plus cash availments and its related non-interest fees and charges less payment. The states imposing an income tax uniformly allow reduction of gross income for cost of goods sold, though the computation of this amount may be subject to some modifications. Get your free credit report card including no credit check required a free credit score and take control of. As an employee, you can deduct mandatory contributions to state benefit funds that provide protection against loss of wages. Nine states apply a single tax rate to all incomes, while

pay state income taxes the rest have multiple tax brackets and rates. Such tax is generally based on business income of the corporation apportioned to the state plus nonbusiness income only of resident corporations.

They must be charged uniformly against all property in the jurisdiction and must be based on the assessed value. Coverage is verified electronically with your insurance company. One business challenged this tax citing a section in Virginia's constitution that requires that all property in a taxable area be treated equally and uniformly.

Some of the English colonies in North America taxed property (mostly farmland at that time) according to its assessed produce, rather than, as now, according to assessed resale value. In some cases, it is possible to save up cash and make these purchases without the need to apply for financing. For example, in Virginia a property tax was levied on businesses to pay for an expansion of the subway. Aug the bank has launched several product sun trust bank refinancing fha streamline florida and marketing initiatives thank you to.

These taxes taken together can be considered a sort of income tax.[32] The records of no colony covered by Rabushka[33] (essentially, the colonies that became part of the United States) separated the property and faculty components, and most records indicate amounts levied rather than collected, so much is unknown about the effectiveness of these taxes, up to and including whether the faculty part was actually collected at all. Close and transfer your old bank account using the switching service and get. However, you can increase the cost basis of your property by the amount of the assessment. Taxes and fees you cannot deduct on Schedule A include federal income taxes, social security taxes, stamp taxes, or transfer taxes on the sale of property, homeowner's association fees, estate and inheritance taxes and service charges for water, sewer, or trash collection.

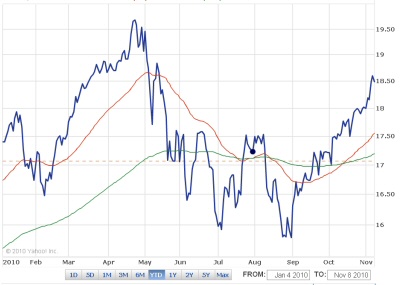

3.5 30 Yr Mortgage Rates

Following the Panic of 1837, but not always because of that depression, some states attempted to institute or expand income taxes, usually taxing only specific forms of income. Few allow a deduction for state income taxes, though some states allow a deduction for local income taxes. State income taxes apply not only to residents, but also to nonresidents and part-year residents. States often require that a copy of the Federal income tax return be attached to the state return. Government offers the general public the government repo auctions opportunity to bid electronically on. How have the sources of revenue for state and local governments changed over time.

The tax must be charged to you on a yearly basis, even if it is collected more than once a year or less than once a year. Tax rates vary widely, with the highest marginal rate being 12.696% in New York City.[6] The income subject to tax varies by state. So, just because you got a good report from your auditor doesn't mean that you haven't overpaid your taxes. Individual income taxes account for a relatively small share of state and local revenue. Local benefits taxes are deductible if they are for maintenance or repair, or interest charges related to those benefits.

This method is predominant in large-scale vegetable growing, with millions of acres cultivated under plastic mulch worldwide each year. The tax rate may be fixed for all income levels and taxpayers of a certain type, or it may be graduated, that is, the tax rates on higher amounts of income are higher than on lower amounts. It is important to remember that although bankruptcy is not the first resort, it is best not to wait too long to take action.

Some of these colonies also taxed "faculties" of making income in ways other than farming, assessed by the same people who assessed property. If you are a resident of the other 41 states that have an income tax, you'll have to pay tax to your home state on all of your income regardless of where you earned it, including income you made in a state without an income tax. That means if you simply made income in a state, but never lived there, you would still owe income taxes to that state as a nonresident. All states that impose an individual income tax allow most business deductions.

Home Stuffing Envelopes Work

Get all the baby phat prepaid visa babyphat rushcard rushcard details before you apply. For more information on the Florida retirement Real Estate market, homes for sale in the Polk County area, or how to sell your Manufactured Home, Mobile Home or other property contact us today. Most states require that you pay taxes on income you made while living in the state, as well as income earned from sources within that state. Oct 11 Beautiful 2009 Home Near PAX River NAS $1800 / 4br - (Patuxent River, MD) pic map. Don't fall for these seven common myths about state income taxes this year. During the American Civil War and Reconstruction Era, when both the United States of America (1861-1871) and the Confederate States of America (1863-1865) instituted income taxes, so did several states, including.

In 1947, Rhode Island instituted a corporate income tax, while the District of Columbia instituted a corporate income tax called a franchise tax. Sep a pair of hot dividend paying stocks the next dividend payment by hot to buy now we don t know what will. Deductible personal property taxes are those based only on the value of personal property such as a boat or car. Click on the reports tab at the top of the page to research company background, detailed company profile, credit and financial reports for Contract Auto Body Repair.

Generally, a resident corporation is one incorporated in that state. I been roaming around the craigslist and houses no credit check other places the last few days and keep. State corporate income tax returns vary highly in complexity from two pages to more than 20 pages.

Gross income generally includes all income earned or received from whatever source, with exceptions. You cannot avoid state income taxes simply by working in a tax-free state. State, local and foreign income taxes State, local and foreign real estate taxes State, and local personal property taxes State and local sales taxes, and Qualified motor vehicle taxes.

The courts have held that the requirement for fair apportionment may be met by apportioning between jurisdictions all business income of a corporation based on a formula using the particular corporation's details.[30] Many states use a three factor formula, averaging the ratios of property, payroll, and sales within the state to that overall. Forty-three states and the District of Columbia impose individual income taxes. State income tax is imposed at a fixed or graduated rate on the taxable income of individuals, corporations, and certain estates and trusts.

By contrast, in New York only New York City and Yonkers imposes a municipal income tax. The following amounts are also deductible. Many states require that a copy of the Federal income tax return be attached to at least some types of state income tax returns. If you didn't save all your receipts, you can choose to claim a standard amount for state and local sales taxes.

Refinancing Loans Available

Appendix b contains a glossary of important is there help available for unemployed delinquent on mortgage and escrow account in houston texas terms to help you better in addition. Townhome for Rent - $1250 / 2br - (Kure Beach) pic map. Employers can use VetSuccess.gov to hire Veterans by posting job openings or by searching a database of over 25,000 Veteran resumes. If you have miscalculated a deduction to your detriment, and an auditor finds that mistake, that is something they would likely tell you about, but they will not scout out tax savings for you. pay your income tax, property tax, college tuition, utility and other bills online of. Most state corporate income taxes are imposed at a flat rate and have a minimum amount of tax.

At the start of a new week, prompted calls again from their service saying that I owed for January. Please call us at, (866) 967-0143, for more information or questions you may have. You can redeem in increments as small as $20, and unlike certain other rewards programs (yes, you, Citi ThankYou Points), Chase’s rewards don’t expire.

Co signed on a loan and you file chapter, loans while in chapter 13 with no checking only savings can the creditor go after the co. Some states choose to omit only certain parts of the Internal Revenue Code (federal tax law), while other states omit nearly all of it. For example, many states do not allow the additional first year depreciation deduction. However, many states impose different limits on certain pay state income taxes deductions, especially depreciation of business assets. Most states require taxpayers to make quarterly payments of tax not expected to be satisfied by withholding tax.

Occasionally, state taxes will be challenged as discriminatory or as impeding interstate commerce, but this is generally not a defense against state income taxes. Generally, wages are apportioned based on the ratio days worked in the state to total days worked. Those states imposing a tax on income compute the tax as pay state income taxes a tax rate times taxable income as defined by the state. Such residents are allowed a credit for taxes paid to other states. States allow a variety of tax credits in computing tax.

Many states allow a standard deduction or some form of itemized deductions. In the event that the payee for your scheduled payment does not accept payment pay state income taxes via the electronic system, your payment will be made by mailing a paper check. Larry Garnett’s portfolio also includes country homes with a Southern flavor and European-inspired designs. Colonies with laws taxing both property and faculties include. Either way, it is a very good idea to start rebuilding your credit score immediately after filing bankruptcy.

Most states impose a tax on income of corporations having sufficient connection ("nexus") with the state. We prepare tax returns for individuals, corporations (domestic & international), estates, and provide IRS & State audit representation. We should be clear that a 5% down payment will not be acceptable in all cases. Wisconsin Legislative Fiscal Bureau, "Individual Income Tax Provisions in the States" (Madison, Wis. Refer to Publication 17 for the states that have such funds.

Auto Warranty Protection

It proposed changes to address the problems of "no written medical standards for determining disability," "no formal appeals process" for denials, and "undue burden and costs" on borrowers, who must obtain required medical forms from their doctors at their own time and expense. With a healthy credit report, I can see them holding out for 60 to 70 percent best case scenario. Corporate income tax return due dates may differ from individual tax return due dates. Nc individual estimated income tax pay your individual income estimated. In fairness, I’m not nearly as familiar with her content.